Some Known Details About Medicare Advantage Agent

An external testimonial is done by an external testimonial organization acquired by the Massachusetts Workplace of Patient Protection. You need to request for an outside allure from the Massachusetts Workplace of Patient Security within 4 months of receiving the decision on your inner appeal. Your internal charm notification must give the form to request an exterior review and other details concerning requesting an outside review.

Health and wellness insurance coverage continually ranks as one of the most essential advantages amongst staff members and job hunters alike. Using a team wellness strategy can help you maintain an affordable benefit over various other companies specifically in a limited job market. When workers are worried about exactly how they're going to manage a clinical trouble or spend for it - they can come to be worried and sidetracked at the workplace.

It additionally supplies them comfort recognizing they can manage treatment if and when they require it. Medicare Advantage Agent. The decision to offer employee health benefits typically comes down to a matter of cost. Many tiny business proprietors forget that the costs the amount paid to the insurer each month for coverage is generally shared by the employer and staff members

8 Simple Techniques For Medicare Advantage Agent

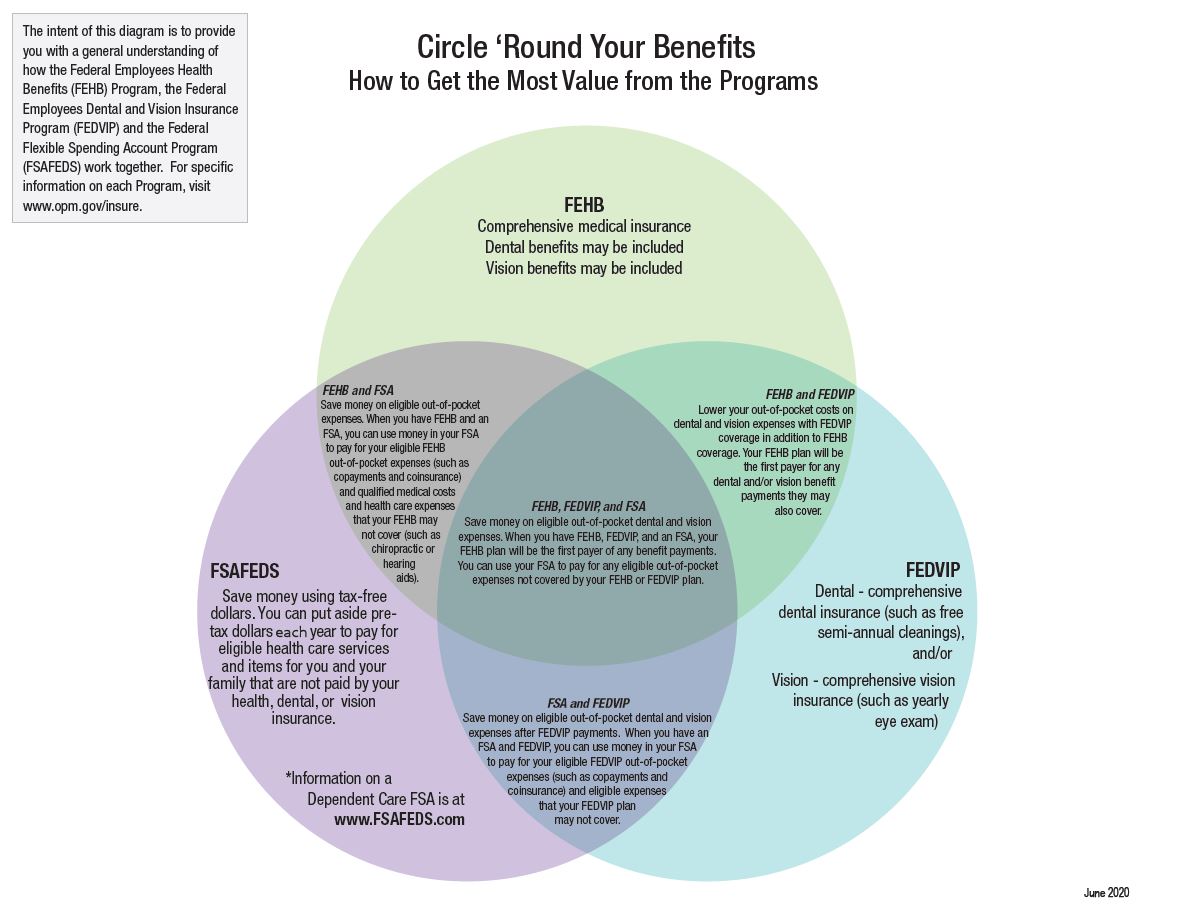

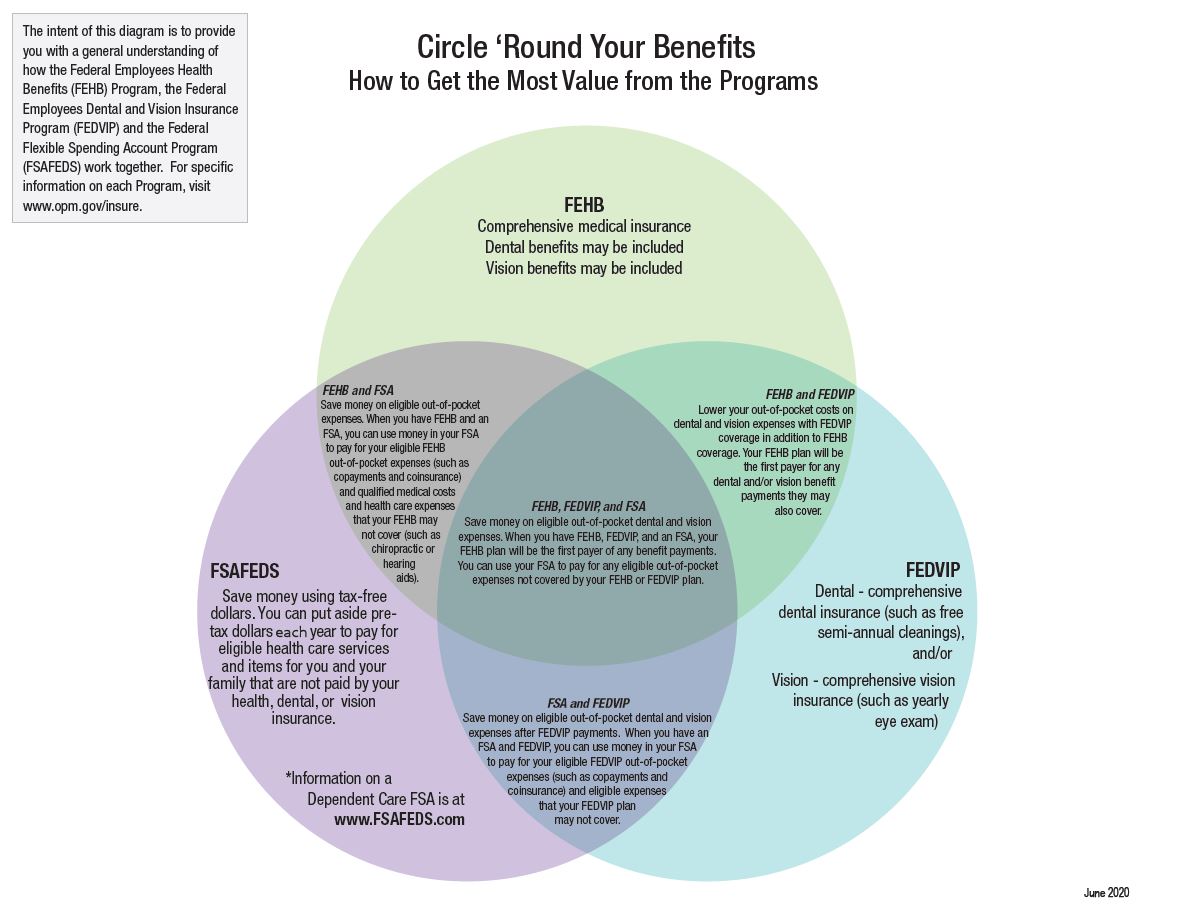

These options can include clinical, dental, vision, and extra. Discover if you are qualified for protection and enroll in a strategy through the Industry. See if you are eligible to make use of the Health and wellness Insurance coverage Industry. There is no earnings limit. To be qualified to register in wellness protection via the Market, you: Under the Affordable Care Act (ACA), you have special person security when you are guaranteed through the Wellness Insurance Industry: Insurance companies can not decline coverage based upon sex or a pre-existing condition.

No person intends to get really ill or pain. However when it takes place to you or your family members, it can cost a lot of money to get care. Medical insurance can protect you from these high costs. If you purchase medical insurance, it can easily cost you less money than going to the hospital without it.

That means, you can get healthy and remain healthy and balanced. Health insurance still sets you back money and choosing the ideal policy for you can be difficult. Suppose you currently have insurance policy? The details listed below can assist you recognize the plan you currently have and assist you when you are purchasing brand-new protection.

Learn more about the kinds of advantages to anticipate when you have medical insurance. Discover more about the price of medical insurance consisting of things like co-pays, co-insurance, deductibles, and costs. The Client Defense and Affordable Care Act was checked in 2010 by President Obama. Go to this web page for click here to find out more more information concerning what these modifications suggest for you.

Fascination About Medicare Advantage Agent

It will summarize the vital features of the plan or coverage, such as the protected advantages, cost-sharing provisions, and protection restrictions and exemptions. People will get the recap when buying coverage, enlisting in protection, at each brand-new strategy year, and within 7 business days of asking for a duplicate from their medical insurance issuer or group health strategy.

Thanks to the Affordable Care Act, consumers will certainly additionally have a brand-new source to aid them understand some of the most typical however complicated lingo utilized in wellness insurance policy (Medicare Advantage Agent). Insurance provider and group health insurance will certainly be called for to provide upon demand a consistent reference of terms frequently made use of in medical insurance coverage such as "deductible" and "co-payment"

Medical insurance in the united state can be confusing. Many individuals do not have accessibility to good insurance coverage they can afford, and numerous people don't have any medical insurance in all. There are a lot of broad view modifications that the federal government requires to make so that health and wellness insurance works much better.

The Best Strategy To Use For Medicare Advantage Agent

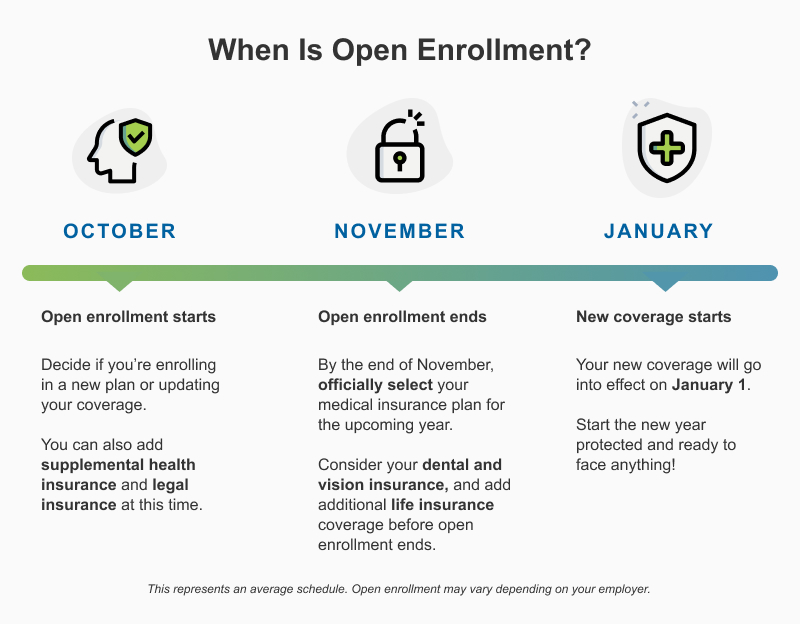

"Sometimes insurer additionally make changes to benefits in terms that are normally relevant upon revival of the policy, and so you intend to make certain that you're reviewing those and you recognize what those modifications are and just how they may influence you," Carter says. It's also worth inspecting your benefits if your health and wellness has actually changed recently.

"If consumers can just make the evaluation of their medical insurance plan a typical technique, it's something that becomes easier and simpler to do in time," states Carter. Exactly how a lot you see post use your medical insurance relies on what's going on with your health. An annual physical with your health care medical professional can maintain you current with what's taking place in your body, and provide you an idea of what kind of wellness treatment you could require in the coming year.